Digital Onboarding With ID Verification API

Identity Verification API integration automates documentation processes and ensures hassle-free seamless onboarding that helps firms to manage various milestones in the client verification journey. Business organizations can achieve better productivity, efficiency, and high TAT when these onboarding workflows are optimized.

Due to customer due diligence (CDD) procedures, KYC verification has become a mandatory process for all regulated industry sectors when onboarding individuals or businesses to prevent fraudulent activities and identity theft. ID verification APIs help an individual or organization to verify personal or business identity on digital Application Programming Interface (API) platforms. Due to a marked diversity in types of IDs available to both persons and businesses, there are numerous ways to validate KYC details

ID verification APIs are among the fastest & most convenient tools for businesses to undertake this process.

What is an Identity Verification API?

ID verification is the process of verifying the identity of an individual or business. ID verification enables document authentication and identity verification. An ID verification API is a quick & easy way to validate credentials or identity proofs on real-time API platforms.

An ID check ensures that there is a real entity or valid business behind a process and proves their authenticity. It helps prevent fraudulent activities, false authorizations, identity theft, money laundering, and financial crimes.

API-integrated solutions provide end-to-end and secured KYC verification with assured regulatory compliance. ID verification APIs streamline KYC documentation while enabling superior risk management and reducing documentation errors.

Types of ID Verification APIs – For Persons & Businesses

There are many available API integrations that are used for ID verification. Individuals as well as businesses can authenticate their identity through various API platforms. An ID verification API is effective in helping clients to complete their KYC verification in just a few minutes.

ID verification can be classified into two broad categories, depending on the end users of the APIs –

- Individual Verification: These APIs verify the identities of individuals including clients, employees, and freelancers. The IDs used to verify individuals include documents such as PAN, Aadhaar, Passport, Voter ID & more. Individual ID verification can also be done through bank account validation, ensuring seamless and secure digital student onboarding.

- Business Verification: These APIs are used to verify businesses including partner businesses, vendors, suppliers, distributors, and more. Typically business identities are verified using GST, CIN/DIN, and Udyog Aadhaar number.

Individual Identity Verification APIs

Individual Verification APIs involves using different types of standard issue IDs as identification proofs. The APIs used for this purpose include –

- PAN Verification API

The PAN Verification API is one of the easiest ways to verify an individual’s identity. The PAN verification API extracts data from the front image of the PAN card and verifies the data with retrieved pre-validated data in the ITD database.

PAN verification API is useful for the BFSI (Banking, Financial Services, and Insurance) sector. It is an economic tool to track monetary transactions, and can also be used to prevent fraudulent activities and identity theft.

- Passport Verification API

The Passport Verification API is a convenient way to verify the identity of an individual of international importance. With the help of the file number of the passport and front & back images, data is extracted from the uploaded images through OCR technology. The data is retrieved from the government database, matched, and verified.

Passport verification API is effective in nationality verification, international travel, foreign studies, international clients, and representatives from multinational businesses.

- Voter ID Verification API

The Voter ID Verification API is another easy way to identify an individual with core personal information such as name, father’s name, DOB, age, gender, address, and Epic number. In this process, data is extracted from the uploaded or scanned images through OCR technology and verified with the pre-validated voter data in the archived government database.

Voter ID Verification is mostly used to verify an individual’s identity when there are no other requirements.

- Driving License Verification API and Vehicle RC Verification API

The Driving license API is a fast way to verify user data in the KYC process. The process is the same as before mentioned procedure of extraction using OCR and validation with pre-verified data. Along with the Driving License details, the vehicle registration number is used as a request for Vehicle RC verification API. The RC verification API fetches the pre-validated data pertaining to the specific vehicle and the owner along with manufacturer and insurance company details.

These APIs are needed in the Insurance sector for identifying the authenticated insurers to carry out the insurance and policies.

DigiLocker – the online document management system, serves as a useful tool for ID verification. In particular, customers wary of submitting hard copies of their Aadhaar can be offered DigiLocker KYC to preserve security & process integrity. Customers simply upload their KYC documents onto DigiLocker and provide FIs access to these documents for verification purposes. Users enter their DigiLocker-associated mobile number on the KYC interface, authenticate themselves via an OTP sent to the same number, and the FI Receives KYC details such as name, date of birth, address & gender. Users can also enable FIs to verify their Aadhaar details via the same DigiLocker API.

- Aadhaar XML Verification API

Aadhaar XML Verification is a KYC verification process that extracts and validates user data from a downloadable Aadhaar XML file using the respective Aadhaar number and OTP. Aadhaar verification API is one of the convenient ways of eKYC verification because it is linked with other government-issued ID proofs and all other data about an individual can be validated with an Aadhaar number.

Aadhaar XML Verification API is the most used and reliable API as it validates all the necessary data along with biometric proof. The OTP feature ensures the identification of the individual and acts as double authentication.

- Bank Account Verification API & UAN Verification API

Bank Account verification API leverages account number and IFSC code to cross-check the propriety of bank accounts. Along with bank details verification API, financial institutions can use UAN verification API as well to verify individual identity with PF UAN number by receiving employee identification and banking data.

This API is used in the BFSI sector to verify the account status and account activity. This API is useful for gaming platforms as well.

- Penny Drop Verification API

Penny Drop verification API is one of the most convenient ways of bank account verification API to authenticate a valid beneficiary bank account and proprietor. In this process the customer makes a penny drop i.e. transaction of INR 1 validating the account status. This method is useful for identity verification and fast KYC verification.

Business Identity Verification APIs

For business verification, business identification proofs can be used to accurately verify commercial organizations. The methods used by these APIs are similar to individual verification but on a larger economic scale.

- GST Verification API

The GST verification API uses the GSTIN number to verify the pre-validated data against extracted data of the uploaded or scanned image of the GST certificate.

GST can be verified with the PAN as well. This API uses the GSTIN number to receive pre-validated data of PAN and GST-related data.

GST verification is extremely important for business organizations. For bulk seamless onboarding the GST verification API proves to be helpful.

- MSME Verification API

The MSME Verification API leverages the Udyog Aadhaar number of MSMEs to fetch details of the specified enterprises. The validated data verifies the status of the business along with the business name and type, DIC & NIC codes, state, and location.

Medium and Small Enterprises can easily verify their business KYC with udyam verification API with smooth bulk onboarding in a fast and secure way.

- CIN & DIN Verification API

CIN (Corporate Identification Number) Verification API is an efficient API to verify corporate KYC and company authentication. CIN verification API uses the CIN number of a company to verify the details of the respective company such as company ID, company type, name, associated directors, and business status.

Similarly, DIN (Director Identification Number) Verification API is a co-related way to verify corporate KYC through the director and the DIN number. The DIN verification API uses the DIN number to verify the details pertaining to the associated director validating his name, DOB, address, and associated companies.

List of Popular ID Verification APIs

ID Verification for Individuals

| ID/Credentials Used | API Input Data |

Validated Data |

|

PAN |

|

|

|

Passport |

|

|

|

Voter ID |

|

|

|

Driving Licence |

|

|

|

Aadhaar XML |

|

|

|

Bank Account Details |

|

|

|

DigiLocker KYC |

|

|

ID Verification for Businesses

|

ID/Credentials Used |

API Input Data |

Validated Data |

|

GST

|

|

|

|

MSME Details |

|

|

|

CIN |

|

|

|

DIN |

|

|

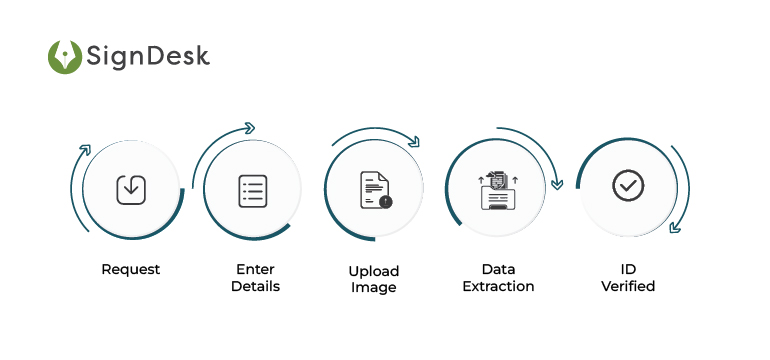

ID Verification APIs – Process Flow

API integrations adhere to different process flows. Document Verification on the API platform depends on the type of document. Based on the nature of the document that requires verification, certain steps are followed for each ID verification API.

Both individual and business API either use data-centric or document-centric KYC extractions for the specified ID proofs. When images of ID proof are needed, data is extracted in the AI-powered OCR technology. Data-centric documents are simply verified by pre-validated resources.

- Request

The client sends a data extraction API request to start the ID verification process

- Enter Details

The end user inputs relevant details of the ID proof for individuals or businesses

- Upload Image

The client uploads a clear image of ID cards as required, the API has access to the camera and is allowed the capture the image of the IDs wherever applicable.

- Data Extraction

Wherever data is entered through images, the information on the image is converted into machine-readable texts, and data is extracted through AI-powered OCR technology.

- ID Verified

Verification algorithms authenticate the data with data retrieved from standard databases using data aggregate match algorithms.

To verify IDs via DigiLocker, customers simply upload their OVDs (Official Valid Documents) to DigiLocker once and then provide permission to banks and insurers to view & verify these documents.

Typically, users receive an OTP on their DigiLocker-registered mobile number. After this OTP is verified, the financial institution in question receives KYC details for authentication.

DigiLocker KYC is a good option to provide secure & convenient KYC verification for customers who are wary of sharing their Aadhaar or other documents with a third-party entity.

ID Verification APIs For Various Industry Segments

API integrations help firms to streamline KYC documentation and ensure seamless onboarding. Different API integrations have massive impacts on various industry segments.

Here are the most effective and useful ID verification API implementations for industry sectors.

- Banking and Financial Services

Traditional banks are thriving to compete and keep their financial market secure in the modern age of digital banking. Implementing API integrations enables banks, NBFCs, neo banks, financial institutions, and FinTech companies to digitize onboarding operations and create progress.

Banks use API services to provide fast and remote digital KYC for ease of banking, smooth onboarding, and optimal customer experience. With the help of APIs, transactional time becomes faster enabling fast and smooth banking services.

DigiLocker KYC APIs are especially useful for financial institutions as they help enhance convenience for customers while preserving security, to enable friction-free onboarding.

- Insurance

With a wide range of use cases, API integrations can be implemented within the insurance sector for secure and easy policyholder verification.

By leveraging API, insurers can access larger volumes of data which enables them to cross-verify details with smart risk evaluation in real-time for fact-checking and to reduce the manual process of entering underwriting data. The API platform acts as a bridge between partners and customers where sharing data is secured and mutually beneficial for both parties.

DigiLocker KYC for insurers offers a secure and convenient alternative by allowing customers a one-time upload of all their KYC documents. These can later be viewed and verified by insurers following user permission.

Insurers can streamline their processes highlighting their policy quotes and claims with fast onboarding and efficient customer experience.

- Travel and Hospitality

In the age of digital transformation, the travel and hospitality sector is extensively leveraging APIs to verify potential customers from the comfort of their homes over the internet.

On API platforms, businesses can easily enable fast transactions and secure booking for travel and hotel reservations. The implementation of APIs in the hospitality sector enhances customer experience with better value-added services which ensures greater profits and competitive business advantages.

- Real Estate

Real Estate companies can utilize ID verification APIs to verify the identities of buyers and sellers for secure property transactions and to provide property listing data from MLS to an agent website or real estate application. These API tools work as an intermediary between real estate brokers and customers.

With the help of APIs, businesses can get real-time property and real estate information. Additionally, API platforms ensure security and trust between dealers and clients.

- Manufacturing

Manufacturing Industry requires APIs to streamline complex procedures from raw material procurement to the distribution of finished products with proper due diligence across the supply chain.

APIs can be integrated along several touch-points in the supply chain to verify manufacturers, vendors, sellers, and eventually consumers themselves. In every step involving verification, APIs have proven to be an integral part of manufacturing systems and in managing crucial workflows.

- IT Sector

Most business organizations and enterprises in the IT sector rely on several software vendors and third-party entities to undertake operations. Implementing APIs helps these firms achieve digital transformation in their vendor onboarding processes and optimized workflows for data processing.

APIs streamline documentation processes and KYC verification, making partner onboarding smoother and easier. IT companies can grow exponentially in a paperless environment by enhancing onboarding security & transparency using API platforms.

Business Challenges In Traditional KYC

Organizations face numerous setbacks when utilizing traditional KYC verification. The problems are universal and any organization is likely to have experienced these problems that hamper business growth.

- Manual Documentation Errors

The common problem in data entry is a manual error which leads to documental error and affects the overall workflow and slows down processes. Poor documentation or undocumented workflows act as the weakest link for both inefficiencies and cyber-attacks.

- Data Risk

Data breaches & identity theft are some of the most feared problems in traditional KYC. Data leakage can easily happen in paper-based workflow along with data loss, data fabrication, and other fraudulent activities.

- Time-Consuming Processes

Management of various workflows and data within the confines of paper-based workflows is a challenging task for every sector. Such workflows are often time-consuming, involve massive amounts of documentation, and directly result in increased margins.

- Low Efficiency and Productivity

With slow workflows, the onboarding process eventually ends up adversely affecting overall business growth and revenue due to low productivity and efficiency. Lowered operational capacities further cause business organizations to struggle to stay competitive.

The Benefits of ID Verification APIs

ID verification API ensures digital KYC verification within a few minutes on online platforms. Verification through API is the most convenient way as it follows a fast process with fewer details in a secure way.

- Real-time Verification

ID verification APIs processes in real-time API platform. It ensures the authenticity of the specific individual and prevents any chance of identity theft. In a real-time process, verification can be done instantly.

- Instant Onboarding

By helping create accelerated validation workflows, ID verification APIs provide the facility of seamless & hassle-free onboarding.

- Fast and Secure Authentication

ID verification API executes the verification process without depending on any third parties. It enhances the speed of the process in a secured digital platform. API gateways and web app firewalls are effective in mitigating cyber threats and preventing most fraudulent activities.

- Secure Document Repository

With DigiLocker integrations, customers can store all their KYC documents in one digital vault. This removes possibilities of misplaced documents, mitigates ID fraud, and enhances accessibility for customers unwilling to share hard copies of their KYC documents. By leveraging DigiLocker, FIs can enhance the onboarding experience and get Aadhaar verified in minutes.

- Low TAT for Crucial Workflows

With easy onboarding and seamless digital KYC, the productivity and efficiency of the businesses increase at an astounding rate slashing TAT by up to 50% and operation costs by 85-90%.

SignDesk’s Integrated API solution

SignDesk is a SaaS-based global software solution provider offering a wide variety of API-integrated solutions that can help businesses to complete KYC verification instantly and create seamless onboarding journeys in a paperless environment.

Here are some of the Identity verification API services SignDesk offers:

- PAN verification API

- Pan Aadhaar Link Verification

- Digi Locker KYC API

- Aadhaar Verification API

- Driving Licence Verification API

- Voter ID verification API

- Passport verification API

- CIN and DIN verification API

- GST verification API

- Udyam verification API

- Bank account verification API

- Vehicle RC verification API

- UAN verification API

- UPI Verification API

- MRZ Verification

- FSSAI verification API

Watch different ID verification APIs in action today by booking a free demo and get KYC verified instantly from anywhere.